Transportation Maintenance Fee FAQs

Streets in Happy Valley are kept to a high standard. Unfortunately, maintaining local roads is becoming a bigger challenge. After several years of evaluating dedicated funding options for street maintenance and several open houses, the City of Happy Valley is considering implementing a new Transportation Maintenance Fee in the spring of 2016.

These frequently asked questions and answers are intended to provide greater context and background of transportation funding.

Why isn’t there enough funding available to meet current needs?

One of the more significant local resources for streets are transportation System Development Charges that are paid by developers, and those funds are limited to new road construction. For local cities, that leaves the state gas tax as the only resource for road maintenance. Unfortunately, this revenue source has been declining across the nation. As a result of vehicles becoming more fuel efficient, the gallons of gas sold in Oregon has steadily decreased since the mid-2000s. While our wallets and the environment benefit from advancements in fuel economy, it means less revenue is generated to maintain local roads.

Further complicating a decrease in revenue, is an increase in the cost of road construction and maintenance due to inflation. For every mile of road that Oregon could build in 1993, ODOT could only build about a half-mile in 2014.

Happy Valley isn’t alone in this challenge. Recently, the Oregon Department of Transportation (ODOT) estimated that investment in the state transportation system needs to increase by $405 million per year, nearly double the investment today, to maintain our highways and bridges to acceptable standards.

What are the local maintenance short falls?

The current revenue only provides resources for a minimal amount of street preservation on the City’s primary roadways. With the current level of street maintenance funding, the City will continue to accumulate a backlog of maintenance needs that will become increasingly expensive as the pavement condition declines. A summary of the current pavement maintenance backlog is provided below, totaling almost $5 million.

Street Maintenance – Arterial Streets

$688,919

Street Maintenance – Collector Streets

$680,007

Street Maintenance – Local (Neighborhood) Streets

$3,558,943

Street Maintenance – Total Backlog

$4,927,869

Additional funding is needed in order to meet existing needs and catch up with accumulating maintenance requirements.

Can the City delay road maintenance?

Ongoing pavement maintenance is very important, not just for safety, but to save tax dollars. It is estimated that full restoration of a street costs as much as fifty times more than maintaining a street in good condition.

Vehicle traffic and weather break down the surface of a street, causing cracks to appear. The cracks allow water to get below the surface to the foundation of a street, weakening it and breaking it down. As the subsurface erodes, a system of “alligator” cracks appear on the surface, indicating the foundation is beginning to fail.

When the damage reaches the critical stage, potholes appear, meaning the subsurface has fallen apart — causing it to collapse. Even though temporary pothole patches can be done, by the time potholes appear, the surrounding pavement and subsurface are so deteriorated that patching materials cannot properly adhere or withstand traffic loads. Regular pavement maintenance can add life to a street by repairing the surface layer to prevent water from getting to the sub-structure below. Since pavement maintenance costs a fraction of street reconstruction, early action saves a lot of money later.

How much additional revenue is needed to meet our needs?

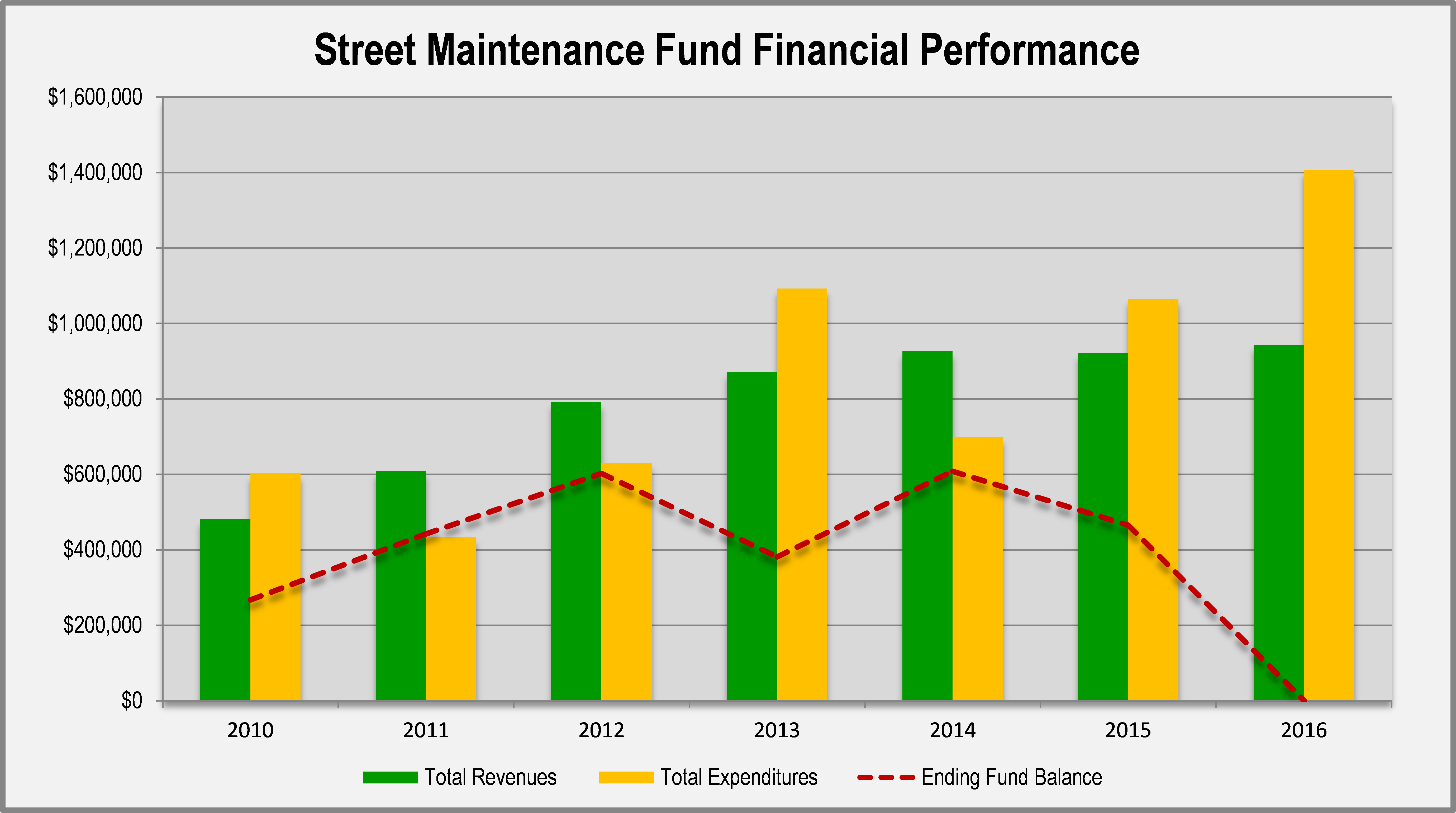

Currently, the primary revenue source for street maintenance is the City’s allocation of the statewide gas tax. These funds go directly into the “Street Maintenance Fund.” For the fiscal year 2015-2016, the City’s revenue from the gas tax allocation was budgeted to be $900,000. Yet, expenditures of more than $1.4 million are necessary to maintain the roads. Spending at levels greater than the amount received this year is possible due to savings from prior years. The recent history and projected current year performance of the Street Maintenance Fund is summarized in the table below – including the expected consumption of the available fund balance.

What is the potential cost to residents?

The City staff and the City Council reviewed a number of possible rate structures. Revenue from the fee would be dedicated to street maintenance and would address the needs of all street types in the city.

In order to meet the needs identified in the City’s pavement management program over twenty years, initial rates would vary between $4.62 and $7.68 per month, depending on the rate strategy chosen.

Possible rate strategies include:

- Constant: Setting an initial rate of $7.68 that would meet needs without increases for the next ten years;

- Yearly: Setting an initial rate of $4.62 to meet current needs, and then indexing it for inflation every year up to $11.01; or

- 3-Year: Setting an initial rate of $5.08 that would meet current needs for the first three years, then indexing it for inflation every three years after that up to $11.90.

Options to Address the Funding Shortfall

The City Council doesn’t take the implementation of a new fee lightly. For the past several years, the City has researched and discussed with citizens numerous ways to address a critical shortfall to fund streets.

There are a number of local transportation funding options that could be available to the City of Happy Valley. The City reviewed the following to determine the best fit for Happy Valley.

- State Fuel Tax

- Local Fuel Tax

- Transportation Maintenance Fee

- Right-of-Way Fees

- General Fund Revenues

- System Development Charges *

- Local Improvement Districts *

- Urban Renewal Districts *

- Special Assessments *

- Special Programs (Grants & Loans) *

- Direct Appropriations *

- Conventional Debt *

As the above list shows, sources of local transportation funding range from local taxes, fees, and charges. In addition, there are state and federal appropriations and grants. All of these resources have constraints based on a variety of factors. New taxes or fees can be a burden to citizens and businesses, existing revenues compete with other popular community programs, and federal and state resources are awarded through competitive processes that are unpredictable.

Furthermore, several funding options have additional limitations related to the type of projects that are eligible for funding. Many options cannot fund basic road maintenance. Each of the sources noted with an asterisk is available for capital construction only – not street maintenance.

The City Council does not take the implementation of new fees lightly. If you have any questions or feedback, please contact Chris Randall, Public Works Director, at 503-783-3842 or [email protected].